How to Find Owners of Properties

in Connecticut

If you're looking to do a property owner search in Connecticut, you'll find that getting the information you need is straightforward. Connecticut has a Freedom of Information Act, which means you can access public records, including those related to real estate. These records are open to everyone, and you don't need to explain why you're asking.

If you want to know how to find the owner of a property by address, you can request the information for free from local government offices. You can also opt to use the service of a title agency or a commercial service provider for a fee.

Visit Your City or Town Clerk's Office

The city or town clerk's office in Connecticut is where you can find important real estate records. These include deeds, mortgages, liens, and other paperwork that show who owns a property. Each town keeps these records in its registry. It's a public resource anyone can access to learn about property ownership.

To find the property owner by address, you need the property's location, and it helps if you have a legal description of the property.

Many Connecticut towns and cities also have an online presence, which you can use to access property records. Some examples include:

- Hartford Town and City Clerk

- New Haven City Clerk

- Bridgeport City Clerk

- Stamford Town Clerk

- Waterbury City Clerk

For a full list of these offices, check the Connecticut Secretary of the State’s website, which provides contact info and links to access property records across Connecticut.

Review Land Records

The local city or town clerk keeps land records, including property-related papers like deeds and mortgages. Once filed, they review and record the documents. These are available for public viewing.

Connecticut offers an online system where you can find the owner of a property free on town websites. The Connecticut Land Registry allows you to search for property details, including the owner's name, property history, and location.

To search the Connecticut Land Registry, you'll need:

- The property's address

- The owner's name (if available)

- A legal description of the property

The online system is simple and lets you search and download property documents.

Check Property Records at Your City or Town Assessor's Office

The city or town assessor's office keeps important property records. These records include details about ownership, assessed values, property features, zoning, and tax history. If you're interested in a Connecticut house owner lookup, this office is key in assuring property taxes are fair and assessments are accurate.

You can visit your local assessor's office to find out who owns the property. Here's how:

- Stop by the office: Go to your city or town assessor's office during regular hours. It's a good idea to call ahead and see if you need an appointment.

- Have your information ready: Bring details like the property address to help with your search.

- Request copies: You might need to fill out a form and pay a small fee to get copies of the records.

Here's a list of links to the assessor's offices in major Connecticut cities:

- Hartford City Assessor

- New Haven City Assessor

- Bridgeport City Assessor

- Stamford City Assessor

- Waterbury City Assessor

Check Property Tax Records

You can find property tax records in Connecticut at your local assessor's office. These records include the following key details:

- Current Ownership

- Assessed Values

- Tax History

To get a property tax record in Connecticut:

- Identify the town or city: Determine the town or city in which the property is located since property tax records are managed locally.

- Visit the assessor's office website: Go to the town's assessor's office website. Many towns have land records through online searches. You can search by details like property address.

- Search for property information: Use the online search tools to look up the property. You'll usually need to enter the property address or parcel number to retrieve the correct records.

- Visit the assessor's office in person: If you prefer, you can go to the local assessor's office in person during business hours. Be sure to bring identification and any details about the property.

- Prepare for fees: Be ready to pay for copies of the records. Fees can vary by town.

- Contact the assessor's office for help: Contact the assessor's office directly if you run into issues or have specific questions. They can help you with the process and answer any questions.

For more information about property tax records across Connecticut, visit the website of the Connecticut Secretary of the State.

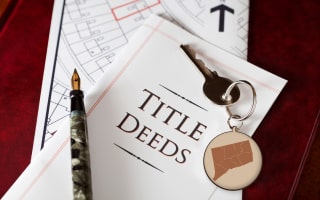

Get Help From a Title Company

In Connecticut, title companies play a key role in real estate transactions. They help make sure property titles are clear and free from any issues. These companies also provide title insurance, which protects you from any future claims on the property.

To do this, they carry out thorough title searches. This means they check public records to confirm who legally owns a property and to find any liens or claims against it.

Title companies have access to a wide range of property records. This helps them offer detailed searches that include the ownership history, mortgages, liens, and any other legal concerns tied to the property. The cost usually depends on what's involved in the search.

![]() Hire a Commercial Service Provider

Hire a Commercial Service Provider

In Connecticut, you can use PropertyChecker.com to find property ownership information easily. You can search statewide for current and past owners. You can also learn about the owners behind businesses and trusts tied to those properties.

If you want to check property records on PropertyChecker.com, just follow these simple steps:

- Visit the website: Go to PropertyChecker.com.

- Enter the property address: Type in the full address of the property you want to look up.

- Check the results: Review the information to learn about current and past owners, including any businesses or trusts connected to the property.

- Explore more information: The site may also show tax records, sales history, and other useful details about the property.

Other Property Info Sources

There are other ways to find out who owns a property in Connecticut, including the following:

- Ask your neighbors: They might know who currently owns the property or who owned it in the past.

- Talk to local real estate agents: These experts can often provide useful information about property ownership.

- Hire a real estate attorney: Lawyers specializing in real estate can help you look up ownership and provide legal advice. Choose one with a good track record.

What Are the Different Types of Property Ownership in Connecticut?

Property ownership means having legal rights over a piece of real estate. You might own property alone, with a spouse, or with others. Knowing how property ownership works affects how you manage, transfer, and tax the property.

Recognizing the types of property ownership helps you make smart choices about holding a title. Your choice of ownership type can impact your risk, liability, financing, probate, and taxes. Picking the right ownership structure can help protect your assets and improve your financial situation.

Several types of property ownership exist, each with financial and legal effects. Here are the most common types:

| Ownership Type | Benefits | Downsides |

|---|---|---|

| Sole Ownership | Complete control over the property. Easy to transfer after death. | Property goes into the estate and may require probate unless a will is in place. |

| Joint Tenancy | Automatic transfer to the surviving owner if one passes away. | Both owners must agree on transactions. Debts of one owner can affect the property. |

| Tenancy in Common | Owners can have different shares and sell their shares. | No automatic transfer on death; shares follow will or state laws, complicating matters. |

| Tenants by Entirety | Extra protection for married couples and includes survivorship rights. | Only available to legally married couples. Both must agree to sell or take out loans. |

| Trust Ownership | Avoids probate, may offer tax benefits, and keeps ownership private. | Setting up and managing a trust can be complex and costly. |

Finding the Owner of a Trust or Corporation That Own Properties in Connecticut

Partnerships, corporations, trusts, and LLCs can own real estate in Connecticut. When properties are held by these organizations, figuring out the actual owner can become more challenging.

If you're tracking down who owns a property that belongs to a trust or corporation, getting help from professionals like real estate attorneys or title companies is a smart move. They can guide you through the steps and provide helpful insights.

If you want to do this on your own, you can do these steps:

Finding the Owner of a Trust in Connecticut

- Check public records: Visit your local town clerk's office. Look for property records that show the trust as the owner. You can also check any documents that name the trustee.

- Contact the successor trustee: If you know who the successor trustee is, reach out to them. They manage the trust and might have details about its ownership.

- Consult legal resources: If you need help understanding documents, talk to a lawyer who knows about trusts. They can help you interpret the information you find.

Finding the Owner of an LLC in Connecticut

- Search the Secretary of State's business database: Use the Business.CT.gov's business entity search tool. Enter the LLC's name for details about its registered agents and members.

- Review public filings: Check for any filings or changes the LLC has submitted. These can sometimes provide ownership information.

- Contact local business directories: Reach out to local chambers of commerce or business directories. They might have more information on local businesses and their owners.

Finding the Owner of a Corporation in Connecticut

- Access corporate records through the Secretary of State: Go to the Business.CT.gov website and use the business entity search tool. Input the corporation's name to find information about its officers and registered agents.

- Examine annual reports and filings: Corporations need to submit annual reports, which often list important details like key officers and major shareholders.

- Use business research platforms: You can explore corporate information in greater detail using business research platforms. These databases provide access to financial statements and details about ownership stakes.

Common Ways to Transfer Property in Connecticut

A property deed confirms who owns the property and outlines the rights being passed to the new owner. In Connecticut, two common types of deeds are available, each with its own guidelines and legal protections for the parties involved:

-

Quitclaim Deeds: Quitclaim deeds pass on the seller's interest in the property without any guarantees.

-

Warranty Deeds: Warranty deeds offer the strongest protection for the buyer. They confirm that the seller has clear ownership of the property and the right to sell it, which safeguards you against future claims.

Less common types of deeds include:

- Grant Deeds

- Deed of Trust

- Bargain and Sale Deed

- Mortgage Deed

Step-by-Step Guide to Property Transfer in Connecticut

Let's break down transferring property into steps to make the process easier to handle:

- Pick the right deed: Start by choosing the type of deed that works best for your situation.

- Check for issues with the title: You'll want to look into potential liens or issues affecting the property. This can be done by going through public records at your local town clerk's office or using online resources offered by some towns.

- Prepare the deed: Create the deed based on Connecticut's legal requirements. It should include all the important information, like the property's legal description and the buyer and seller's names. Getting professional help with this step is a good way to avoid mistakes.

- Take care of transfer taxes: Determine if any transfer taxes apply to your transaction and ensure they're paid. Connecticut's taxes are based on the property's sale price.

- File the deed: Head to your local town clerk's office and submit the finished deed. Once it's recorded, the transfer is official.

- Verify the recording: After you hand in the deed, make sure you get confirmation from the town clerk that your deed has been recorded properly.

- Get a copy for your records: Ask for a copy of the recorded deed for your files. This document acts as proof that you're the owner.

- Update local records: Don't forget to notify the local tax authorities about the transfer so the new owner gets the property tax bill.

- Consider title insurance: If you want extra protection from future claims on the property, you may want to get a title insurance policy.

The process generally takes time. After filing, processing can take anywhere from a few days to several weeks. Legal requirements for deeds include specific language and notarization as per Connecticut General Statutes.

Property Ownership Guide

Connecticut Homeowner Lookup

- Owner(s)

- Deed Records

- Loans & Liens

- Values

- Taxes

- Building Permits

- Purchase History

- Property Details

- And More!